Posted: April 15, 2025

Photo: Tuma

Thermosiphon systems account for more than half of the total installed solar thermal capacity worldwide (status at the end of 2022), but little is published about them. The scientists from Task 69 Solar Hot Water for 2030 have closed that gap. They carried out a survey among manufacturers of thermosiphon systems and received more than 50 answers from 17 countries. Together with desk research and shared insights from task experts, a comprehensive report titled Solar Hot Water Market Analysis will be published in the coming months. It will include a detailed description of the current market situation in eight world regions and gathers interesting facts about future prospects. The planned report will also include a chapter with an analysis of the dynamically growing PV hot water systems market, particularly in South Africa, Australia and the United Kingdom. The report will be available for download from the Task 69 publication website (https://task69.iea-shc.org/publications)

“One of the key characteristics of the global solar hot water market is its regional diversity in terms of market penetration and deployed technologies, etc. This is why we have structured the report across world regions”, explained Daniel Tschopp, one of the key authors of the report. Tschopp worked as a researcher at the Austrian Institute AEE INTEC until the end of March 2025 and was responsible for the survey within Task 69. The thermosiphon survey was carried out between October 2023 and May 2024.

Each regional chapter will describe the market environment and challenges, available product certification, results from the questionnaires, available products, final customer prices, market expectations and conclusions. The eight regional chapters are:

- India (6 responses)

- Japan (2 responses)

- China (12 responses)

- Europe (12 responses)

- Latin America (12 responses)

- Middle East and North Africa (no responses)

- North America plus Caribbean (4 responses)

- Oceania Region (3 responses)

- Sub-Saharan Africa (6 responses)

In the following, we will look at some special topics and trends that could be derived from the survey.

System design: Direct thermosiphon systems are common in warmer climates in China, India, Latin America, Sub-Saharan Africa and the MENA region, where there is no risk of freezing. In colder climates such as in Europe, Japan or Northern China, indirect systems are prevalent. In China, most systems use evacuated tube collectors, whereas in Europe flat plate collectors are dominant. According to the authors, these stark differences cannot be explained by environmental factors alone and are presumably due to economic advantages in the mass production of evacuated tube collector systems, whereas highly industrialized areas favour more expensive flat-plate collector systems with a higher life expectancy.

The authors highlight the case of Puerto Rico, which shows how local manufacturing can be boosted with small and medium-sized enterprises. Starting in 2008, manufacturers were provided with tax incentives for local manufacturing, which led to substantial growth of companies which acquire components from the US-American, European and Chinese suppliers and assemble them in Puerto Rico. The companies Universal Solar and Tanagua are both in the hands of the second generation. Other local suppliers there are Sun for Life and MC Green Solutions.

Use of smart technologies: “Manufacturers should make systems easier to use through smart control, remote access via cell phone, temperature visualization or monitoring apps, which will bring great convenience for users”, emphasized Prof Li Bojia in one of the recommendations of the report. He is a Professor at the Solar Energy Application Center of the China Academy of Building Research in China. It is worth noting that about a quarter of the participating manufacturers already use smart components, especially those from China and India. A trend which is likely to expand rapidly to other markets, According to Bojia.

Prices and cost saving potentials: The authors note that thermosiphon systems exhibit considerable regional price variations due to differences in manufacturing costs, regulatory frameworks and market demand. The authors asked for final customer prices including shipping, installation and taxes for standard thermosiphon systems with a 150 litre tank and 2 m2 of collector area. In low-cost manufacturing hubs such as China and India, typical system prices are in the range of USD 250 to 500 and USD 500 to 1000, primarily due to economies of scale and inexpensive labour. In contrast, European markets, characterized by stringent efficiency standards and high-quality materials, see prices mostly in the USD 1,000 to 1,500 range. Latin American, the Middle East, and Sub-Saharan Africa are positioned in the mid-range, reflecting local economic conditions and supply chain limitations. Prices in Australia are among the highest worldwide, ranging from USD 1,000 to more than USD 2,500 per system, based on three responses. According to the authors the reasons are expensive system designs - almost exclusively indirect flat-plate collector systems – as well as high quality, high labour costs and difficulties in large-scale adoption.

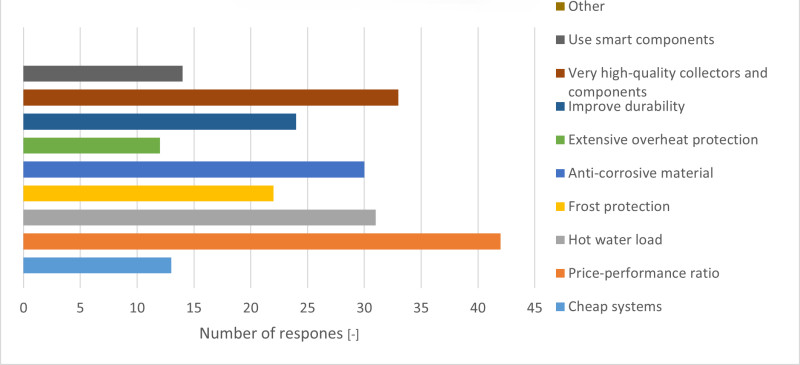

Techno-economic adaptations: results of the multiple-choice question “What techno-economic adaptations have been made to tailor your products successfully to the target market(s)? Source: Task 69

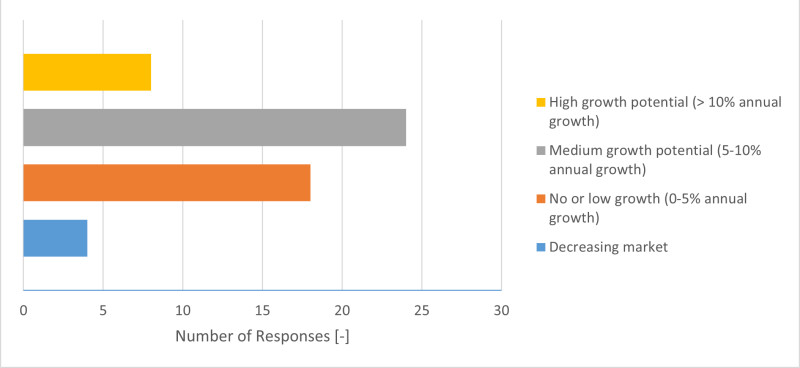

Market development expectations: The manufacturers were also asked about future market potential in the survey (see figure below). Most Chinese manufacturers expect little or no growth, while market players in other regions, especially in Sub-Saharan Africa, Latin America and Europe's Mediterranean area, are more optimistic. In total, the large majority of the companies (78 %) expect a growth rate between 0 and 10 % in the coming years. The authors assume that “urbanization is likely to take a toll on the thermosiphon market, as roof areas become scarce and expectations regarding comfort grow”.

Answers to the question: For thermosiphon systems, how would you describe the future market potential? Source: Task 69

Websites of organizations mentioned in this news article: